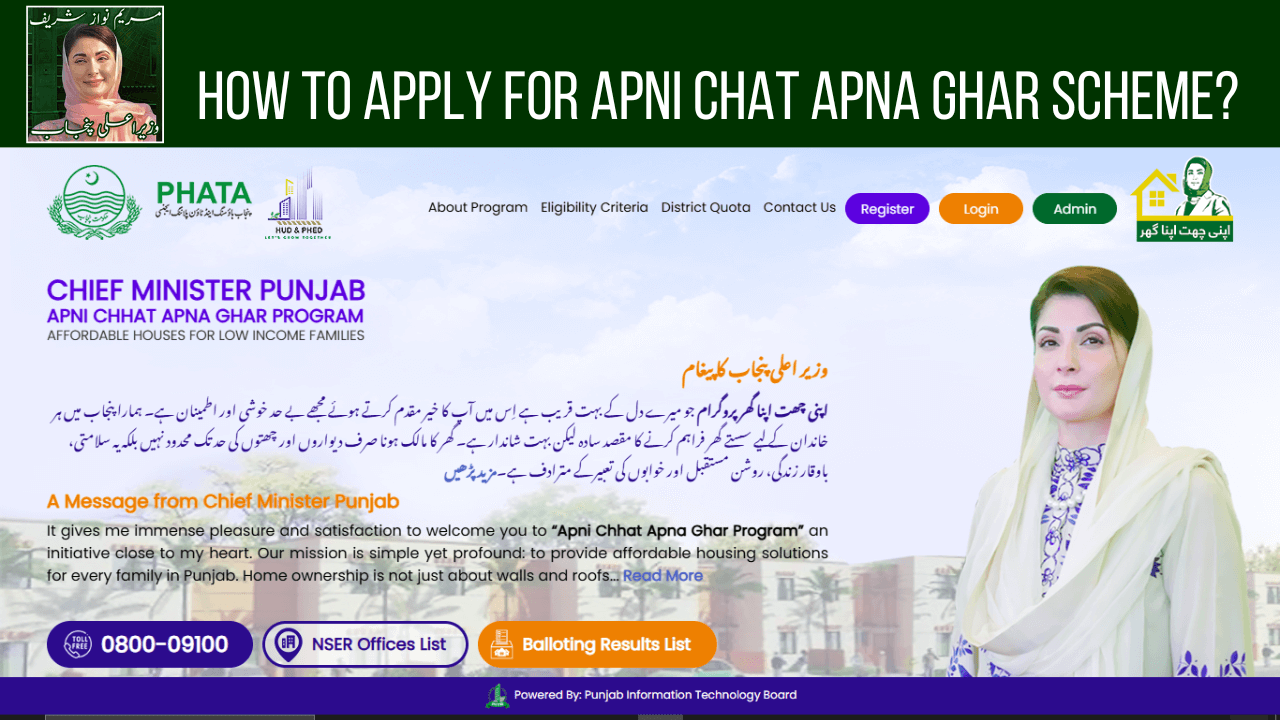

The Apni Chat Apna Ghar Program is a new housing loan scheme that is introduced by Punjab’s Chief Minister Maryam Nawaz Sharif. This program aims to help people in Punjab to build their own homes by providing interest-free loans. The goal is to provide 100,000 housing units under the Punjab Housing and Town Planning Agency (PHATA).

You can apply online for this program at acag.punjab.gov.pk, and each district has its own quota for fair distribution.

Requirements for Maryam Nawaz Apni Chat Apna Ghar Program

1. Main Family Member in NADRA Records

The applicant must be listed as the main family member in NADRA’s records. This means they should be the head of the family according to NADRA.

2. Punjab Resident

The applicant must live permanently in Punjab. Their CNIC must show Punjab as their place of residence.

3. Property Ownership

The applicant must own a small piece of Property where they plan to build their house:

- In cities: The land should be 5 Marla or smaller.

- In villages: The land should be 10 Marla or smaller.

The land must belong to the applicant at the time of applying.

4. No Criminal Record

The applicant must not have a criminal history. This includes:

- No involvement in activities against the country.

- No involvement in illegal or harmful activities.

5. No Loan Defaults

Applicants must not have any history of defaulting on loans from banks or other financial institutions. This criterion ensures that the applicant has maintained good financial standing and creditworthiness.

6. Poverty Score Requirement (PMT)

The applicant must meet the following conditions:

- They must be registered in the National Socio-Economic Registry (NSER).

- The family’s poverty score (PMT) should be 60 or less, which shows they qualify for help.

How to Apply for Apni Chat Apna Ghar Scheme?

If you want to register for Apni Chat Apna Ghar Scheme then you need to submit your application on the ACAG Punjab website. Just follow these simple steps. This guide will help you complete the process without any confusion.

Step 1: Register Online

- Go to the Website: Open your internet browser and visit acag.punjab.gov.pk. Look for the registration page on the website.

- Fill Out the Form: Enter all your basic details, such as your name, CNIC, phone number, and email address. Make sure you provide the correct information.

- Double-Check Your Details: Before submitting the form, check everything again to ensure there are no mistakes.

Step 2: Login and Submit Your Application

- Log In to Your Account: After registration, use your CNIC and password to log in to your account on the website.

- Read the Terms and Conditions: Before filling out the application form please read carefully the terms and conditions. This will help you avoid mistakes.

- Fill out the Application Form: Once you are ready, go to the application form to start filling it out.

Step 3: Complete the Application Form

1. Provide the Required Information:

Fill in the details about:

- Property size (e.g., land area or house size).

- Your current address.

- Your socio-economic profile (e.g., income level, family size).

- Your job or employment details.

2. Add Spouse’s Details (if married):

If you are married, you must also provide your spouse’s information.

3. Upload Necessary Documents:

Scan and upload the following Documents:

- Property ownership document: For villages, upload the Fard document. For cities, upload the possession letter.

- CNIC photos: Upload the front and back sides of your CNIC.

Step 4: Add Remarks and Submit

- Write Remarks (Optional): There is a section at the end for remarks or feedback. You can add comments here if needed.

- Submit Your Form: Once you have filled out all sections and uploaded the documents, click on the Submit button.

Important Tips:

- Double-check all the information before submitting.

- Keep your login details (CNIC and password) safe for future use.

- Use a reliable internet connection to avoid interruptions.

Following these steps will help you register and apply on the ACAG Punjab website. If you encounter any issues, contact their support team for help.

Maryam Nawaz Apni Chat Apna Ghar Scheme Features and Details

- Maximum Loan Amount: The maximum amount you can borrow through this loan is PKR 1.5 million. This means you can apply for a loan up to this limit to meet your financial needs.

- Repayment Period: You will have 7 years to repay the loan. This gives you enough time to manage your monthly payments comfortably.

- Monthly Installments: The monthly installment amount is PKR 14,000. You will need to pay this fixed amount every month for 7 years to repay the loan fully.

- Interest-Free Loan: The best part is that this loan is interest-free, meaning you only have to repay the amount you borrowed without any extra charges or interest added.

- Disbursement of Funds: The loan amount will not be given all at once. Instead, the money will be released in tranches, which means it will be provided in parts over a period of time as per the loan plan.

- Operational Costs: All operational costs related to this loan are covered by the Government of Punjab. This makes the loan program even more beneficial as there are no hidden fees or additional charges for processing.

District-Wise Quota for 100,000 Housing Units

Under the “Apni Chat Apna Ghar” program, each district in Punjab has been given a specific number of houses to be built. This ensures that everyone in different areas of Punjab has an equal chance to apply for a housing loan. The goal is to help 100,000 families across the province get their own homes.

Common Errors and Their Solutions

If you see this message when applying: “Your application draft has been saved, but PMT Record not found against your CNIC,” It means your information needs to be updated. To fix this, go to the nearest NSER Office and update your PMT (Proxy Means Test) score. This will help you complete your application correctly.

Conclusion

The Maryam Nawaz Apni Chat Apna Ghar Program is a beacon of hope for many Pakistani families. By providing affordable housing options, it ensures that more people can enjoy the security and comfort of their own homes. If you or someone you know meets the eligibility criteria, don’t miss the opportunity to apply and secure a better future.